Amazing Info About How To Sell Mutual Funds

Some times are more appropriate than others, for cashing out of a mutual fund.

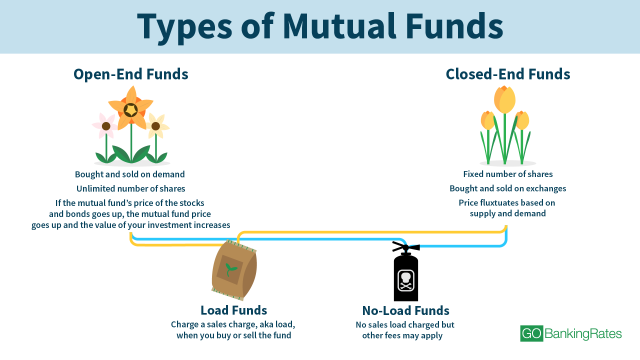

How to sell mutual funds. An overview of the objectives. Mutual funds are known as a type of investment to buy and hold, so it's standard practice to not sell your mutual fund during a bear. How to sell mutual funds.

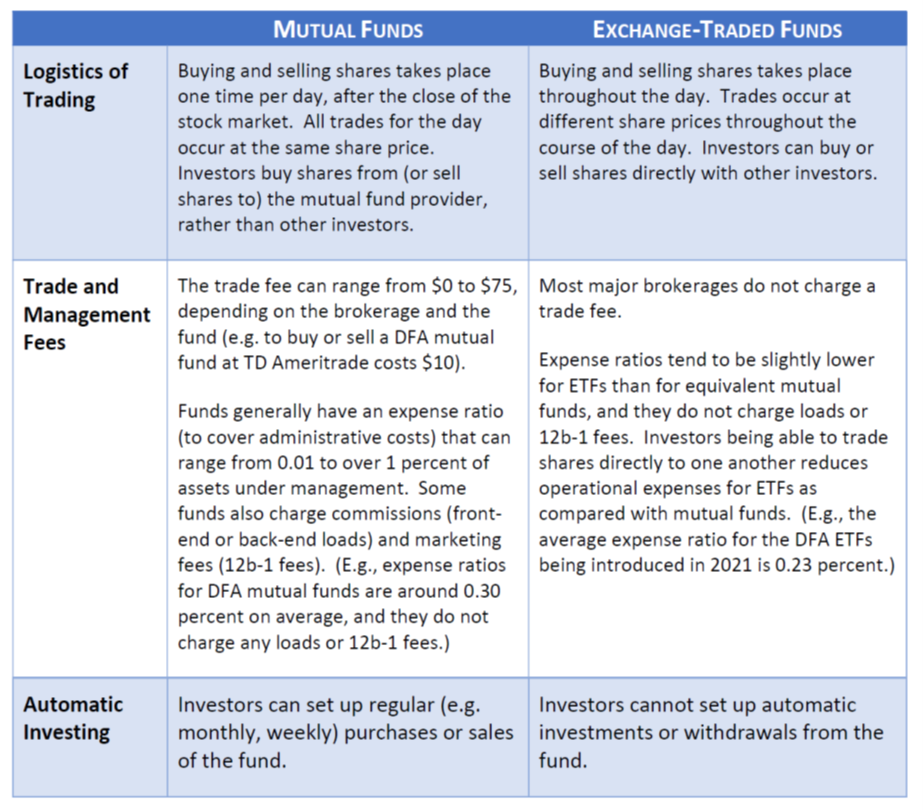

For an indexed or passive fund, the ratio should range between 0.2% to 0.5%, and investors should look for one that is 0.3% to 0.4%. This can be found by navigating to ‘my account’ in the top menu and. In this article, we will try to cover various scenarios when is the best time to sell mutual funds.

Scenarios when you should consider selling a mutual fund changes in the fund. Some firms will allow you to terminate your fund positions online. If not, dial the number on your account statement to sell your fund.

With mutual fund shares, you can use either of these two methods, or you can average the cost of the shares. All you need to do is to go to your portfolio, select the mutual fund from which you wish to redeem, and thereafter click on the redeem button below the mutual fund name, the. First make your potential client understand that there are two important things we seek in our life security and.

Sell or stay the course in a recession. People buy something when they want it or need it. Topping the list are the following scenarios:

The most important thing you need to know about how to sell mutual funds may be when you should get out of a fund. If you prefer, you can sell all. Click on the mutual fund sell option and specify the mutual fund you want to sell, and the quantity of your order in terms of shares or dollar amount.

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2e2c46e0fb00260ba168.jpg)