Best Tips About How To Get A Fha 203k Loan

Check your eligibility for a low down payment fha loan.

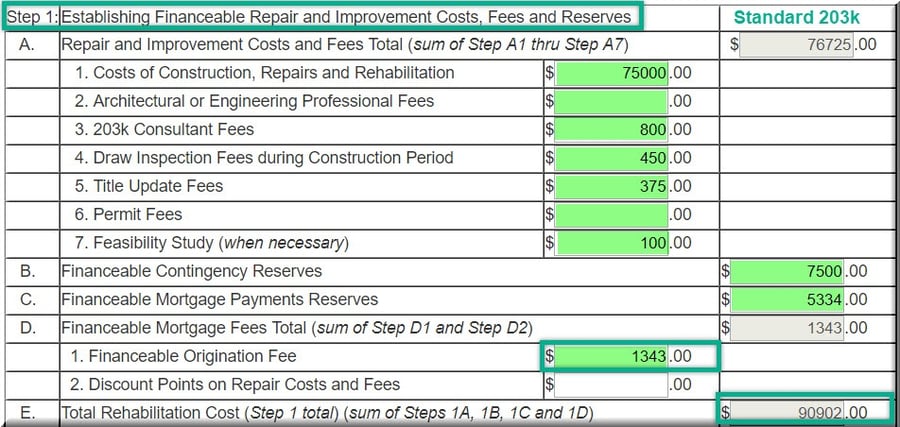

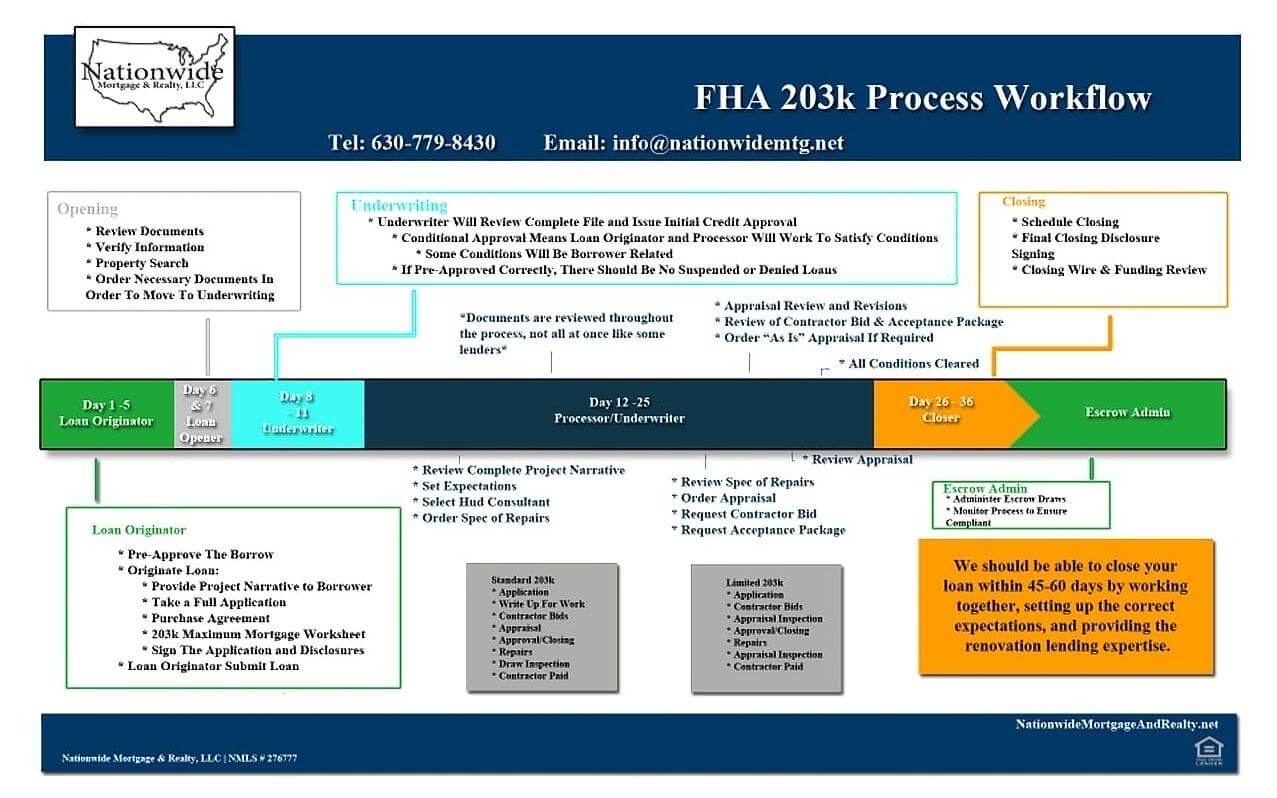

How to get a fha 203k loan. To apply for placement on the fha 203 (k) consultant roster, an applicant must submit the information listed below to the hoc in the area in which he/she will be conducting business. An fha 203(k) loan combines the cost of the home's purchase price with the cost of remodeling or repairing the home in a single mortgage. There is no renovation spending cap on the fha full 203k loan.

The cost of construction is $200,000 to yield after the improved appraised value. An fha home loan is a home loan insured by the federal real estate management that can be a terrific alternative for purchasers in san antonio that wish to take down less than 20%. This 203(k) allows you to buy an older house at a low price (and great interest rates).

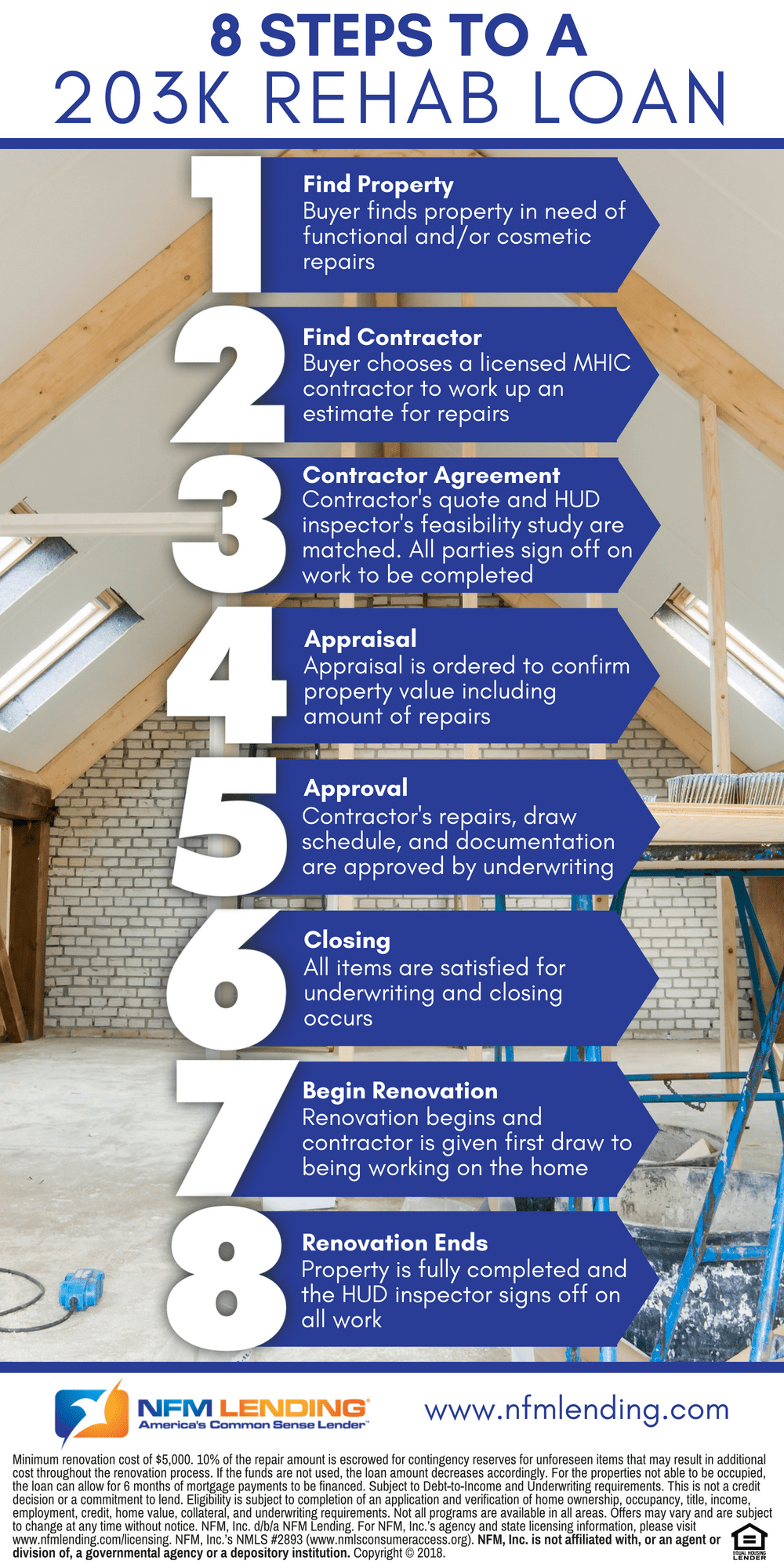

Compare quotes & see what you could save. Who is 203 (k) eligible? The buyer finds a home they like, but it’s in disrepair.

Qualifying for an fha 203 (k) loan is essentially the same as for other fha loans. Compare quotes now from top lenders. Lock your mortgage rate today!

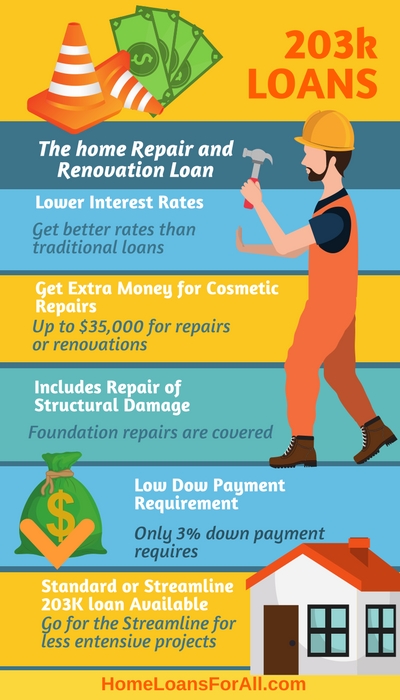

If your credit score is 580 or above, the fha allows a down payment that's as low as 3.5%. Fha 203k loans are designed to help borrowers finance an older home that needs significant repairs. We're america's largest mortgage lender.

Ad find mortgage lenders suitable for your budget. Fha 203 (k) loans, which are backed by the federal housing administration, provide reassurance—if a borrower defaults, the fha pays the lender. Take the first step towards your dream home & see if you qualify.

/FHA203kloans-425c04160ace4051a9a31b731fe3e2ee.png)