Cool Info About How To Fix Ruined Credit

You have to be committed to making real changes to your spending habits.

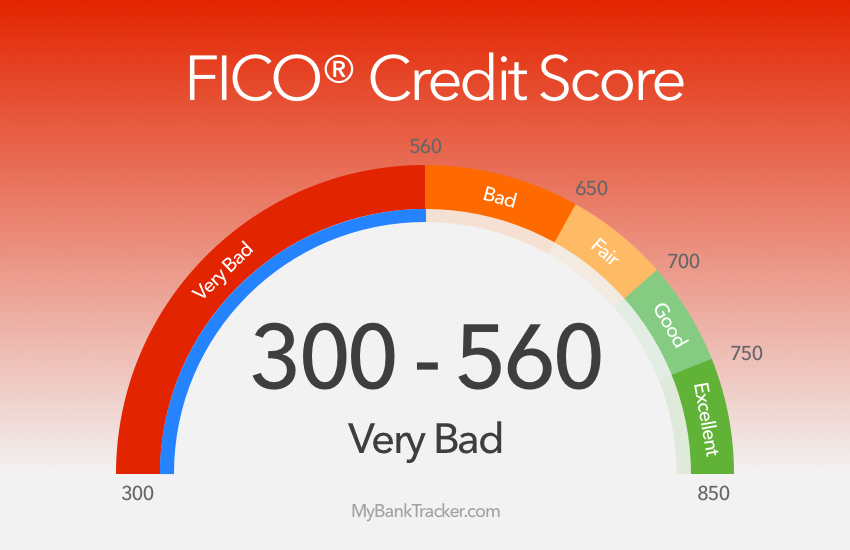

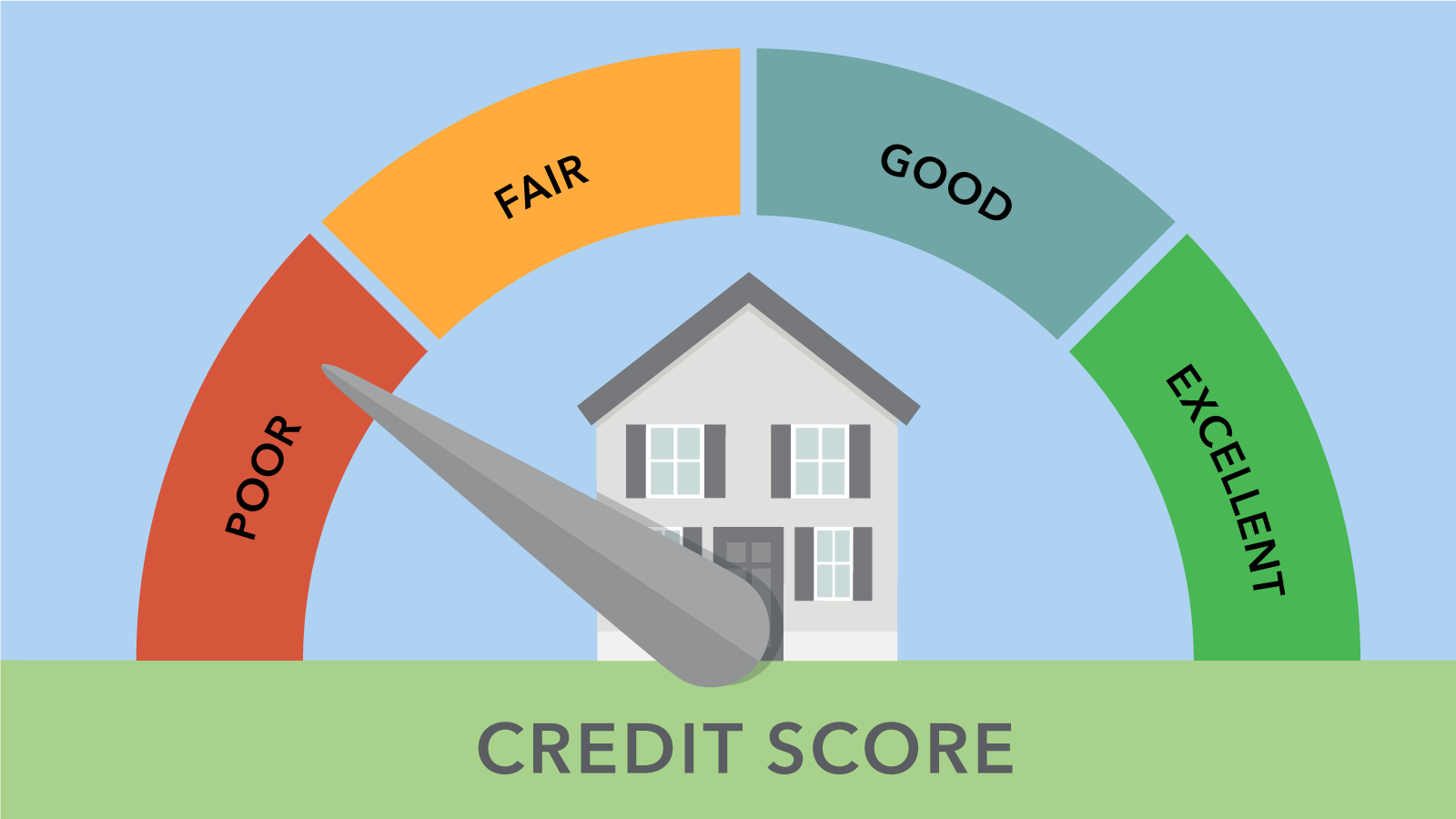

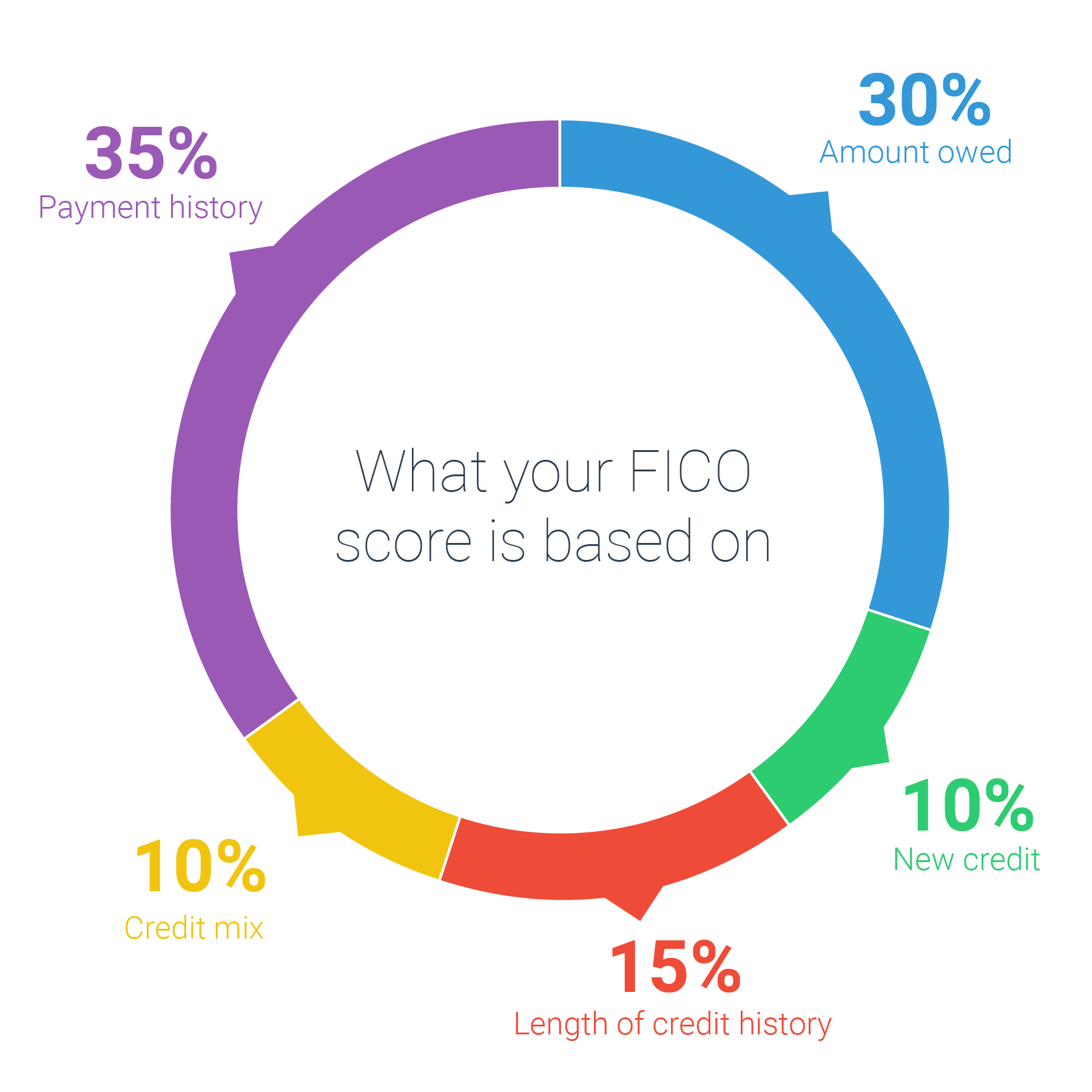

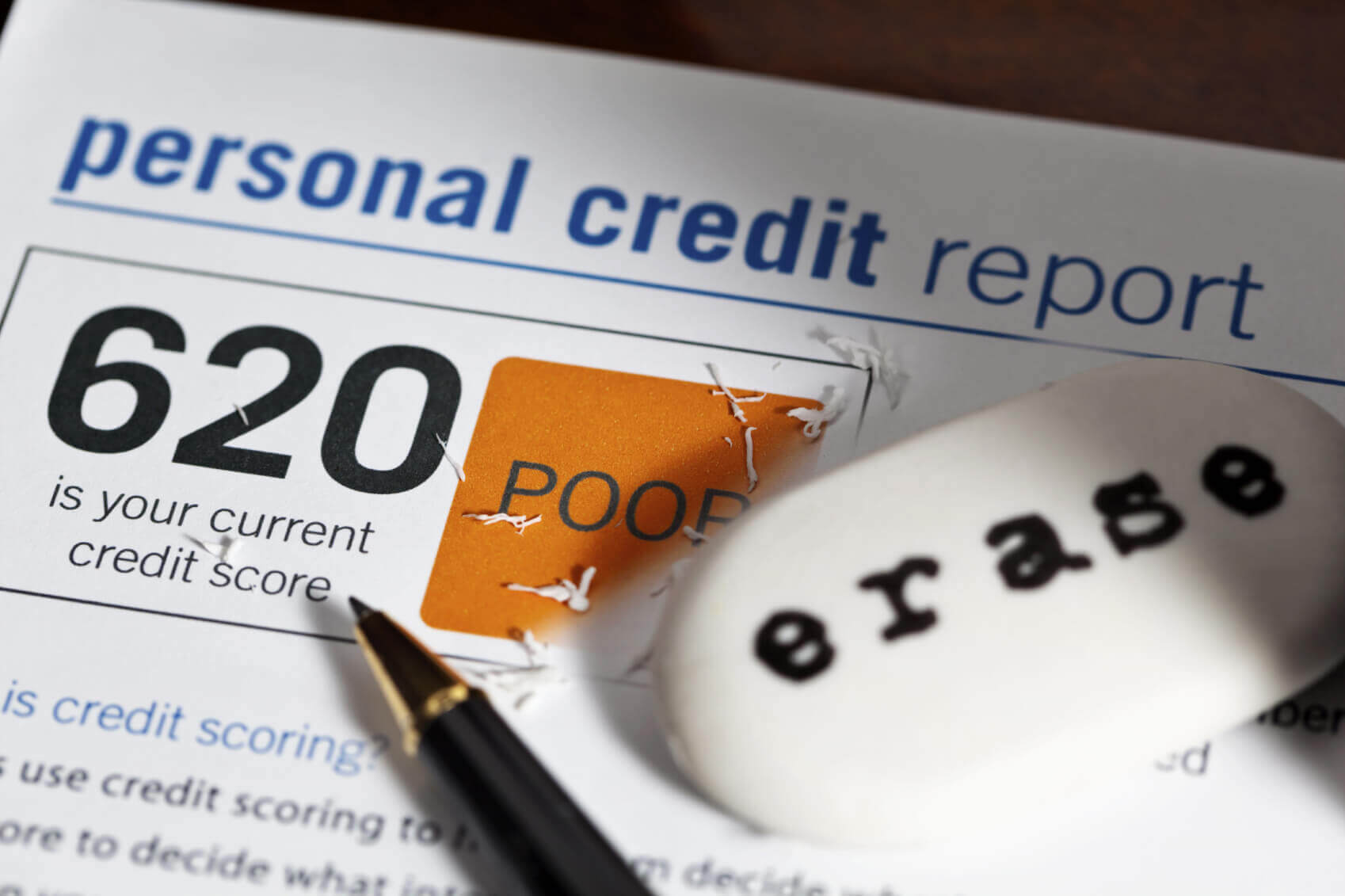

How to fix ruined credit. Learn more about ways to help you rebuild your credit score. If you owe more than half of your credit limit on any credit card, this will have a negative impact. If you know your credit score, you know how far you have to go to get it to “excellent”.

If you have a poor credit. These loans are backed by the united states government. If you need to repair your credit, the first step is to come up with a workable plan and stick to it.

“you have proof your check was cashed, so you send a letter to [the bureau] disputing the late payment,” he said. Close revolving accounts that have been affected. Fha loans offer lower down payments.

Ad bouncing back from difficult financial situations isn’t easy, but it’s possible. Pay down the balance on any credit card that is 50% or more of the credit limit. Discover short videos related to how to fix ruined credit score on tiktok.

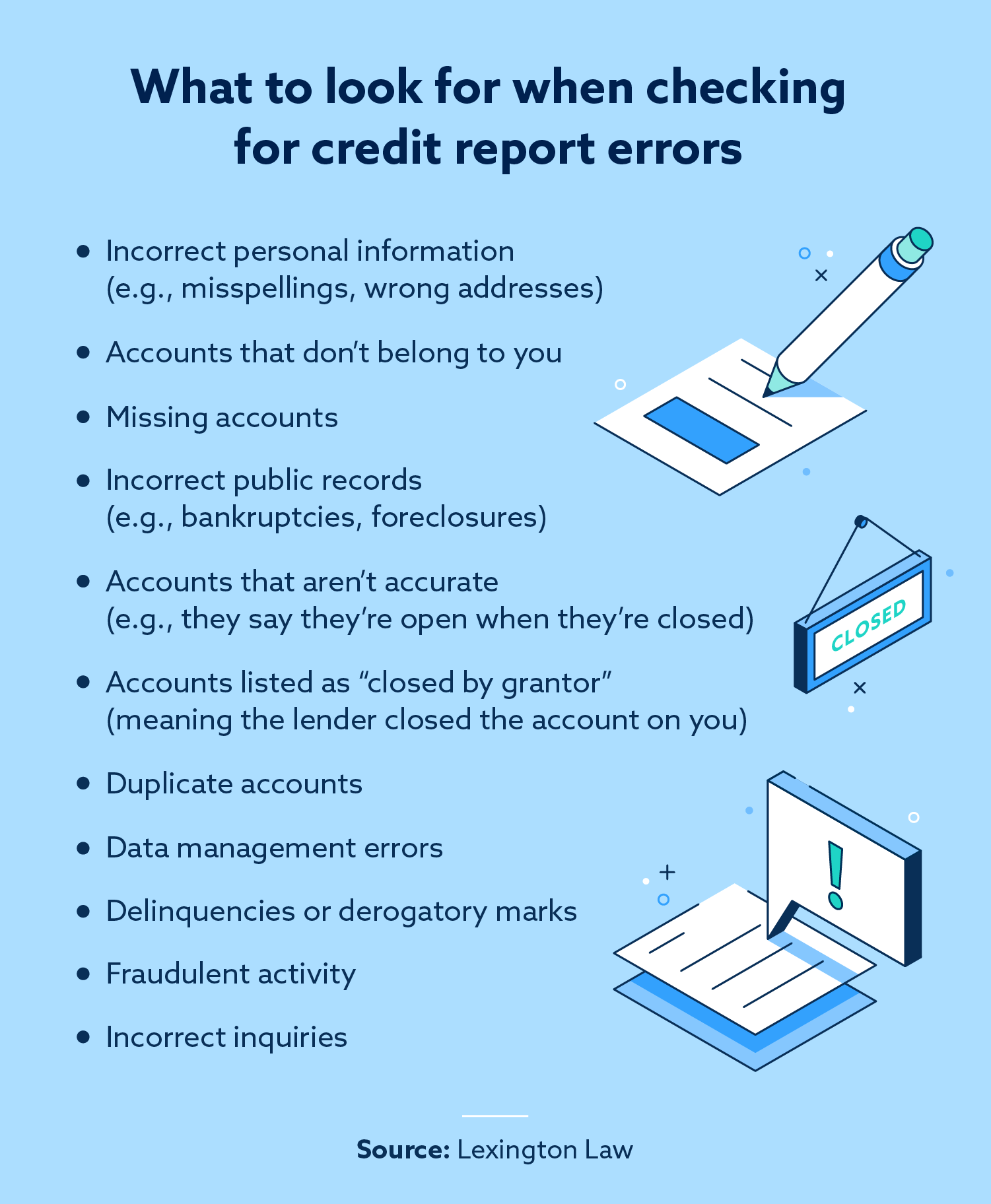

If you do have poor credit, apply for an fha loan; Credit reports contain a history of your credit usage details dating back to 10 years. Continually monitor your credit regularly check your credit report even after your divorce is finalized.

How to fix your credit in 5 steps 1. Every time you apply for a new credit card. Keep your credit card balances below 50 percent of your credit limit.